Are you ready to take charge of your financial health? Download the CreditScore, CreditCard, Loans App today and embark on your journey towards financial freedom! With access to free credit reports from multiple credit bureaus, including CIBIL, you can stay updated on your credit scores effortlessly. The app connects you with personalized loan and credit card offers from India's leading banks and financial institutions, ensuring you find the perfect financial products tailored to your needs. Whether you're in the market for a credit card, a personal loan, or even a home loan, the app offers a diverse range of options to explore. Benefit from expert assistance, instant micro-loans, and pre-approved offers to make managing your finances a breeze. Join the ranks of over 22 million satisfied users and revolutionize your financial journey with the app today.

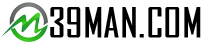

Features of CreditScore, CreditCard, Loans:

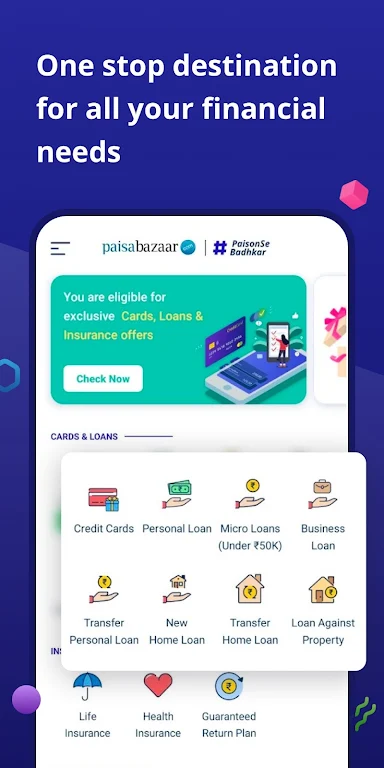

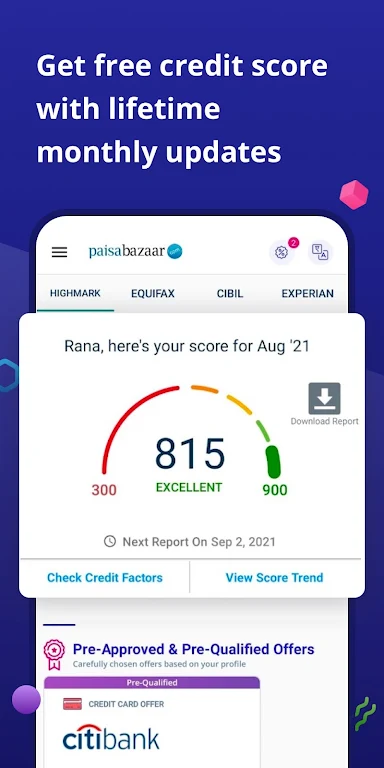

Free Credit Report: Access your credit report from multiple credit bureaus, including CIBIL, absolutely free of charge. Stay informed and in control of your credit health.

Wide Range of Products: With over 60 partners, choose from more than 35 credit cards and instant micro-loans to meet your financial needs.

Personalized Offers: Receive pre-approved loan and credit card offers designed specifically for you. Enjoy instant disbursals and personalized financial solutions.

Easy Comparison: Seamlessly compare, select, and apply for the most suitable loan or card with the help of expert guidance, all from the comfort of your digital device.

Business and Home Loan Options: Discover a variety of business loan offers and home loans with competitive interest rates, tailored to your financial goals.

Secure Platform: Keep all your debit and credit balances in one secure location, ensuring your financial data is protected and easily accessible.

FAQs:

What is the repayment tenure for Personal Loans?

- Personal Loans typically offer a repayment tenure ranging from 3 months to 5 years, allowing flexibility based on your financial situation.

How is the APR calculated for a Personal Loan?

- The APR for a personal loan can vary between 9% to 35%, depending on your credit profile and the lender's criteria.

What are the total costs involved in taking out a personal loan?

- The total cost of a personal loan includes the principal amount, interest charges, loan processing fees, documentation charges, and amortization schedule charges, ensuring you have a comprehensive understanding of your financial commitment.

Conclusion:

With an extensive selection of products, user-friendly comparison tools, and robust security features, CreditScore, CreditCard, Loans is your ultimate financial companion. Empower yourself to make informed decisions and secure the best loan and credit card offers from India's top financial institutions through a seamless digital experience. Make the wise choice for your financial future and download the app today.

![NULL [Remastered]](https://imgs.39man.com/uploads/71/1719651062667fcaf6c483b.png)